Table of Contents

Loan Approval Process how it works ?

Credit Information Bureau India Limited (CIBIL) score plays a critical role in the loan approval process for Indian banking industry.

An individual customer’s credit score provides loan providers with an indication of how likely it is that they will pay back a loan based on their respective credit history.

This article is an attempt to discuss basics Loan Approval Process and working principles of CIBIL score in Indian finance industry keeping a view of individual customer benefits.

Credit Information Bureau (India) Limited or CIBIL

Credit Information Bureau (India) Limited or CIBIL is a Credit Information Company (CIC) founded in August 2000. CIBIL is licensed by the RBI and governed by the Credit Information Companies (Regulation) Act of 2005. Post inception, it has come to play a critical role in India’s financial system.

Whether it is to help loan providers, manage their business or help consumers secure credit faster and at better terms, the use of CIBIL’s products have led to a massive change in the way the credit life cycle is managed by both loan providers and consumers.

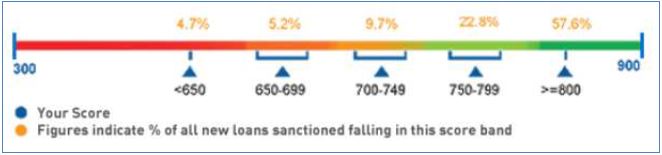

The CIBIL score is a three digit numeric summary of consumer’s credit history which indicates their financial and credit health. The score is derived from their credit history as detailed in the Credit Information Report (CIR) and ranges from 300 to 900 points. CIBIL empowers both loan providers and individuals to see their world more clearly and hence, take better and more informed decisions.

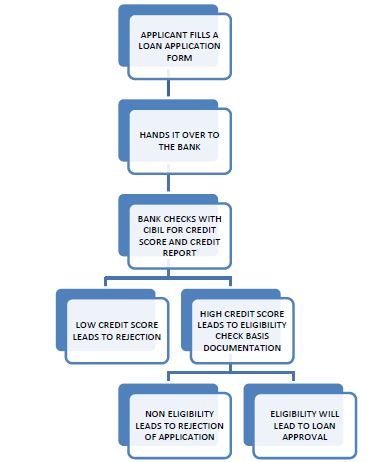

After an applicant fills out the application form and hands it over to the lender, the lender first checks the credit score and credit report of the applicant. If the credit score is low, the lender may not even consider the application further and reject it at that point. If the credit score is high, the lender will look into the application and consider other details to determine if the applicant is credit-worthy. The credit

score works as a first impression for the lender, the higher the score, the better are chances of the loan being reviewed and approved.

What is Credit Information Reports (CIR) ?

CIBIL collects and maintains records of an individual‘s payments pertaining to loans and credit cards.These records are submitted to CIBIL by banks and other lenders, on a monthly basis. This information is then used to create Credit Information Reports (CIR) and credit scores which are provided to lenders in order to help evaluate and approve loan applications. Since 2010, 90% of new loans sanctioned are to individuals with a credit score of 700 and higher.

Overview of Loan Approval Process

Loan approval can be a complicated process. Let’s go through the loan evaluation process to understand the critical role the CIBIL Transunion score plays in getting loan sanctioned.

The credit score helps loan providers quickly determine, who they would like to evaluate further to provide credit. The CIBIL Transunion Score ranges from 300 to 900.

Once the loan provider has decided which set of loan applicants to evaluate, it analyzes the CIR in order to determine the applicant’s eligibility. Eligibility basically means the applicants ability to take additional debt and repay additional outflows given their current commitments.

Post completion of these first two steps the loan provider will request for the applicants income proof and other relevant documents in order to finally sanction the loan.

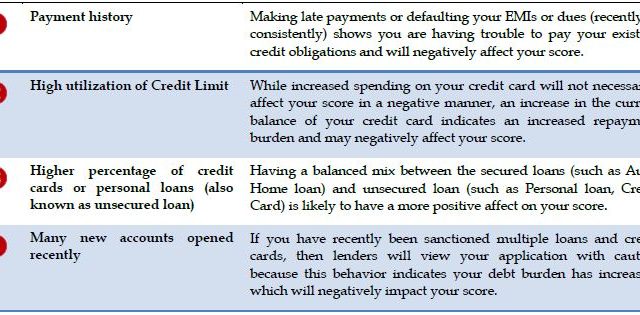

Major factors affecting credit score

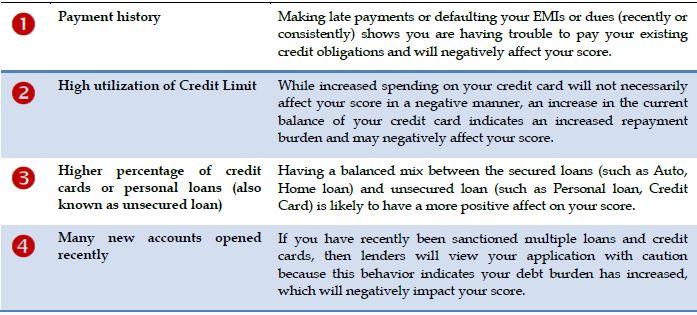

There are four major factors that affect the credit score:

How can I improve my Credit Score ?

You can improve your Credit Score by maintaining a good credit history. This will be viewed favorably by lenders and it can be done with six simple rules.

- Always pay your dues on time. Late payments are viewed negatively by lenders.

- Keep your balances low. Always be prudent to not use too much credit, control your utilization.

- Maintain a healthy mix of credit. It is better to have a healthy mix of secured (such as home loan, auto loan) and unsecured loans (such as personal loan, credit cards). Too many unsecured loans may be viewed negatively.

- Apply for new credit in moderation.. You don’t want to seem Credit Hungry. Apply for new credit cautiously.

- Monitor your co-signed, guaranteed and joint accounts monthly. In co-signed, guaranteed or jointly held accounts, you are held equally liable for missed payments. Your joint holder’s (or the guaranteed individual) negligence could affect your ability to access credit when you need it.

- Review you credit history frequently throughout the year. Purchase your CIR from time to time to avoid unpleasant surprises in the form of a rejected loan application.

Final Conclusion

Since, the credit score and CIR not only helps loan providers identify consumers who are likely to be able to pay back their loans, but also helps them to do this more quickly and economically. This translates into faster loan approvals.

Also, CIBIL has made credits score and CIR available to individuals, hence they will be able to see how valuable a customer they are to loan providers.

Until recently, there was little visibility and transparency with regards to the loan approval process and the elements that loan providers used to evaluate loan application. This is an emerging domain and there is very high scope to learn the principles of CIBIL in detail further.

Also Read : What is Insurance mean? types, risks and benefits