Table of Contents

Meaning of Insurance?

- Insurance is a Risk Management mechanism primarily used to hedge against contingent loss.

- Insurance transfers risk of loss from one entity to the other, in exchange of money.

- Insurance in simple terms is pooling of money by a group of people to distribute it to the unfortunate who make a loss.

- Financial product that protects investors against negative expected outcome of money.

Important Terms involved in Insurance

- Company selling the insurance is called the Insurer.

- Person or entity buying the insurance is Insured.

- Amount paid by insured to insurer is Premium.

- Amount that is asked in return of a loss is Claim.

What is Risk ? Types

Risk is a concept that denotes the precise probability of specific eventualities.

- Different risks that we face are:

- Exposure to a Danger

- Financial loss

- Loss of life

- Uncertain medical condition

- Loss of property

How Insurance and Risk are connected ?

Insurance works on the concept of risk sharing.

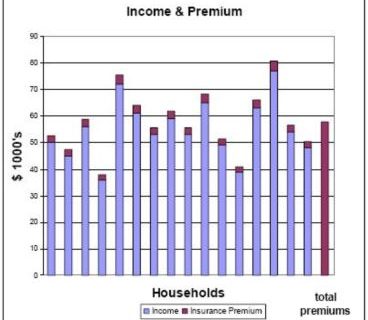

- Consider a group of households all earning wages that wish to protect against sudden income loss (life or property).

- If these households formed a contract to share this risk amongst themselves, then each would contribute a portion of their income (premium) to put in a reserve in the event that anyone household should lose their income.

- Each household contributes an amount proportional to their income. The more income there is to protect, the larger the premium.

- Once these assets are pooled (last bar to right), it should be sufficient to cover the loss of any one individual.

Risk Pool – Concept of Risk Management

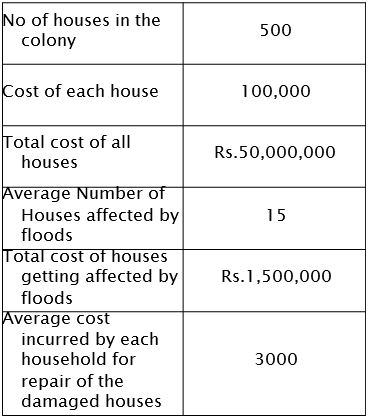

Consider a Colony of 500 houses each costing 1 Lakh rupees. If on an average, 15 houses gets completely destroyed in floods each year, but which houses will get destroyed is not certain.

Then, each household can contribute certain amount of money to a Pool. This money can be spent for rebuilding the damaged houses

Types of Risk covered under Insurance

- Insurance covers only Pure risks – Loss of Life, Property,..

- No insurance coverage for Speculative risk – Stock market

Characteristics of Insurance

All insurance contracts would share common characteristics:

- A large number of units exposed to risk.

- Amount of loss should be definite.

- The loss should be a probability of occurrence.

- Loss must be sizeable, compared to the insured amount.

- Amount of premium for the insurance should be affordable.

- Calculable loss amount. Limited risk of catastrophically large losses

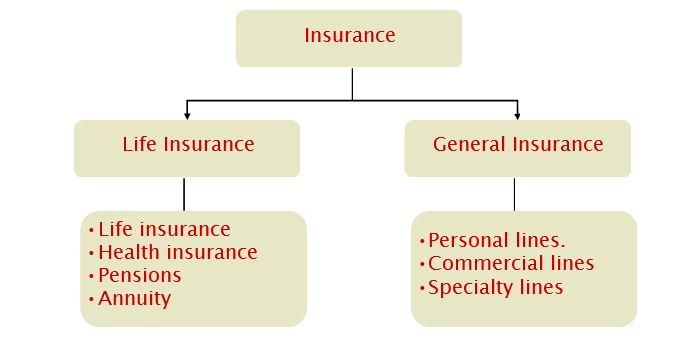

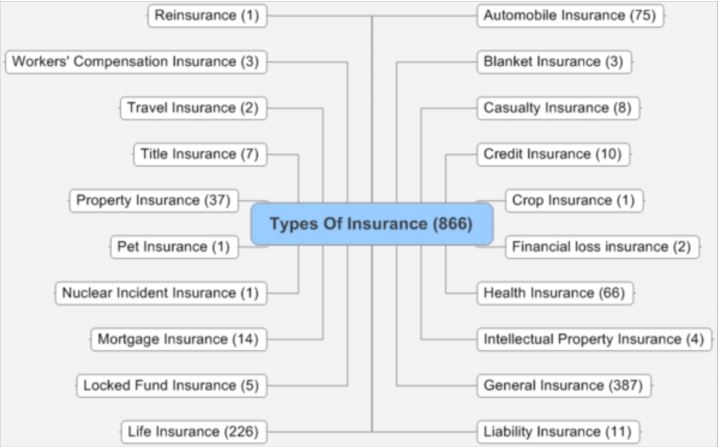

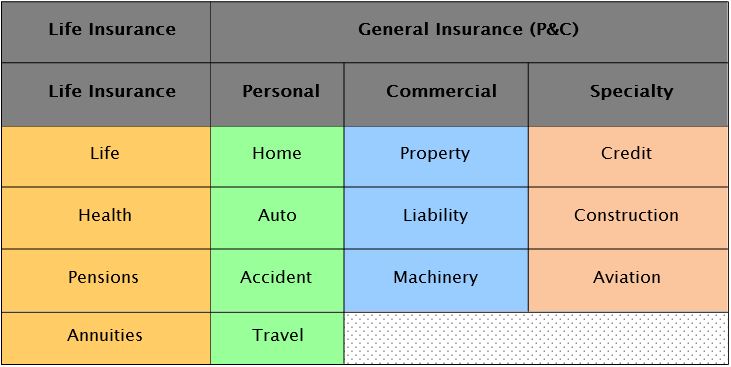

Types of Insurance

Sub Categories of Insurance

Insurance Classfications

Insurance – Statistics

Insurance market in the world constitutes about 8 – 10% of GDP (from sources).

- In India, Insurance constitutes about 3-4% of the GDP.

- Total money in Life insurance premiums in India – Rs. 80000 Cr Aprox.

- Non life Premiums – Rs 20000 Crores Aprox.

- Number of life and Non life companies in India: 35+ companies.

History of Insurance in India.

- 1818 – Oriental life insurance was started in India

- 1870 – Bombay mutual life insurance was started

- 1906 – National Insurance Company Ltd was formed in India

- 1912 – Life Insurance companies Act

- 1938 – Indian Insurance Act was Designed

- 1950 – Insurance Act was Amended

- 1956 – LIC was formed

- 1972 – GIC was formed

- 1996 – Interim IRDA was formed

- 1998 – Insurance Ombudsman was setup

- 1999 – IRDA Act, Foreign investment allowed in Indian companies

For more : List of insurance companies in India

Role of Insurance Regulator in India – IRDA

- Insurance Regulatory and Development Authority (IRDA) was setup after the IRDA bill was passed. It is based in Hyderabad.

- The two primary goals of insurance regulation are to ensure that insurance companies

- Remain Solvent – able to meet their debts and pay policy claims when they come due.

- Conduct business fairly and ethically

- Rules setup by IRDA include:

- Minimum paid-up capital of 100 Crores for insurance companies.

- Reinsurance companies – paid up capital of 200 crores

- Equity requirement. – Maximum foreign partner stake should be 26 percent.

List of Insurance Companies in India – Life

- Life Insurance corporation of India.

- HDFC Standard Life Insurance Company Ltd.

- Max New York Life Insurance Co. Ltd.

- ICICI Prudential Life Insurance Company Ltd.

- Kotak Mahindra Old Mutual Life Insurance Limited

- Birla Sun Life Insurance Company Ltd.

- Tata AIG Life Insurance Company Ltd.

- SBI Life Insurance Company Limited .

- ING Vysya Life Insurance Company Private Limited

- Bajaj Allianz Life Insurance Company Limited

- Metlife India Insurance Company Ltd.

- Future Generali India Life Insurance Company Limited

- IDBI Fortis Life Insurance Company Ltd.

- Reliance Life Insurance Company Limited.

- Aviva Life Insurance Co. India Pvt. Ltd.

- Sahara India Insurance Company Ltd.

- Shriram Life Insurance Company Ltd.

- Bharti AXA Life Insurance Company Ltd.

- Future Generali India Life Insurance Company Limited

- IDBI Fortis Life Insurance Company Ltd.

- Canara HSBC Oriental Bank of Commerce Life Insurance Company Ltd.

- Aegon Religare Life Insurance Company Ltd.

- DLF Pramerica Life Insurance Company Ltd.

- Star Union Dai-ichi Life Insurance Co. Ltd.,

- General Insurance Corporation

- The Oriental Insurance Company Limited

- The New India Assurance Company Limited

- National Insurance Company Limited

- United India Insurance Company Limited.

- Royal Sundaram Alliance Insurance Company Limited

- Reliance General Insurance Company Limited.

- IFFCO Tokio General Insurance Co. Ltd

- TATA AIG General Insurance Company Ltd.

- Apollo DKV Insurance Company Limited

- Future Generali India Insurance Company Limited

- Universal Sompo General Insurance Company Ltd.

- Cholamandalam General Insurance Company Ltd.

- Export Credit Guarantee Corporation Ltd.

- HDFC-Chubb General Insurance Co. Ltd.

- Bharti Axa General Insurance Company Ltd.

- Raheja QBE General Insurance Co. Ltd

- Bajaj Allianz General Insurance Company Limited

- ICICI Lombard General Insurance Company Limited.

This is all about terms related to Insurance let us know in comment if you are interested to know more about Insurance.

Also Read : BFSI Banking, Financial Services and Insurance Questions and Answers

One Reply to “What is Insurance mean? types, risks and benefits”

Comments are closed.