Credit Score | Frequently Asked Question (FAQs) Explained

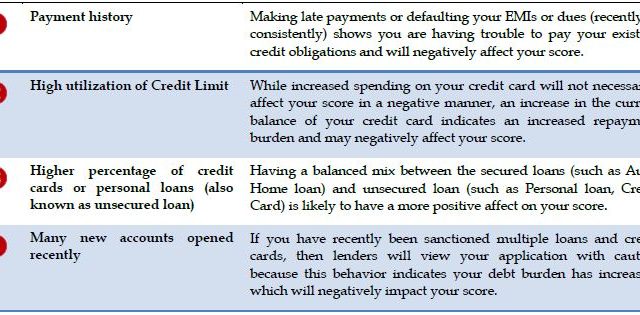

Credit Score – The personal score that is formed as a result of the collection and analysis of all financial history and relations with banks by a joint institution (Credit Registration Office) is called “Credit Score”. The credit rating obtained is used by financial institutions as …