Table of Contents

What is Risk Analysis ?

The risk analysis consists of listing the possible events, evaluating any and all probability that the project developed will go wrong if that event occurs, from this analysis you carry out a survey of the impacts and consequently develop preventive measures, that is, if something goes wrong what will I do to correct, or mitigate that impact.

Typically a risk analysis should contain:

- Impact Matrix;

- Probability Matrix;

- Definition of Risks.

Also Read : What is Credit Risk ? | Methodology and Stages Explained

Impact Matrix:

It is the one in which the set of items that can generate problems if they occur are established.

How can we build this matrix, we must determine the critical elements of the business that could be affected by failures and errors.

Then analyze with the project within each area, whether financial, market, business partner, legal requirements, deadline etc. Finally, everything that may influence the business must be thoroughly evaluated.

With this, you carry out a survey of impacts and estimate what and how much this can affect each step of the process.

After the analysis, the spreadsheet is assembled with all the points that have been identified and are classified into small, medium and large, in this way you can measure the effect size and establish a priority list for monitoring this project, remembering that this does not mean that small and medium-sized companies should not be evaluated, but those with a high impact should always be given more attention, as the size of the damage caused by it will significantly reflect the closing of the deal.

Probability Matrix:

It is the matrix elaborated with the impact matrix data, which involves all aspects in the most varied fields that may exert direct or indirect influence on the project.

For its preparation, the established controls or existing protections that could consequently prevent or minimize these occurrences must be surveyed.

Within this control, assess the vulnerabilities or weaknesses that may exist in the stipulated controls in order to obtain a constant assessment of their effectiveness.

For this, our probability matrix must have the following items, which are considered essential to our matrix:

- Threat type, what can go wrong?

- Critical business element, what can be affected during the development of the work?

- Impact, what is the degree of impact, small, medium, high?

- Control, which elements, measures, tools are being used?

- Vulnerability, how effective can this control be?

- Likelihood, even taking all security measures, what is the probability that this event will outweigh the control action, small, medium, high?

- Risk, it is the result of the multiplication made of the generated impact versus the raised probability.

Risk Definition:

It is knowing exactly everything that could threaten the execution of your business so that you are not taken by surprise.

Risk Analysis Management is undoubtedly one of the main and most important strategic interventions for an Organization, and its performance must be continuous and applied in all departments, as a simple oversight can cost millions, so you can’t think that one or another department is infallible, its strategy must translate tactical and operational objectives, applying feedbacks and reviewing procedures, making comparisons in each project, correlating similar events and developing new techniques.

Measures such as these are of great importance as they underpin proper accountability for performance evaluation and reward, thus ensuring operational efficiency and effectiveness at all levels.

And remembering measures like this do not apply only to the business environment, they are analysis made for life, when you think, evaluate, objectively, worry about the possibility of error, you build a productive management of life and if things go wrong you it may even be impacted, but it will certainly be prepared to react and survive whatever comes.

What is Risk Analysis for?

Organizations use risk analysis to:

- anticipate and reduce the effect of harmful outcomes from adverse events;

- analyze whether risks are outweighed by benefits;

- planning responses and decision making, in case of failures ;

- identify the impact and prepare for changes, such as the likelihood of new competitors entering the market or changes in government regulatory policy.

Benefits of Risk Analysis

For business success, organizations must understand the risks associated with using their systems, thus effectively and efficiently protecting their assets and information. Risk analysis can help organizations to:

- identify, classify and compare the overall impact of risks on financial and organizational aspects;

- identify security gaps and determine next steps to eliminate weaknesses;

- improve communication and decision-making processes related to information security;

- improve security policies and procedures and develop cost-effective methods of implementing such processes;

- implement security controls to mitigate risks.

When done well, this procedure can be an important tool in managing the costs associated with risks and in decision-making processes. Its implementation within companies has been increasingly common and essential.

6 Steps to Risk Analysis

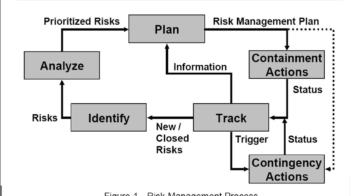

The analysis basically follows the following steps:

- Assessment survey, where you can document specific risks or threats in each department;

- Identification, whether the risk is software or human;

- Risk analysis: once identified, it is time to determine the probability of its occurrence and its consequences;

- Management, based on an analysis of which assets are valuable and which threats are likely to negatively affect, the risk analysis must be able to identify control recommendations that can be used to mitigate, transfer, accept or avoid risk;

- Implementation of the management plan, that is, the execution of measures that will remove or reduce risks;

- Monitoring Finally, the ongoing process of identification, treatment and management must be an important part of any risk analysis procedure.

Risk analysis must be carried out in all businesses, regardless of their segment. It is essential for meeting expectations and for organizations to be prepared for unforeseen events.

In addition to mitigating risks, the analysis also provides a high level of knowledge of the company’s processes, allowing you to get to know your institution even more, always seeking the success of operations.

In an efficient risk analysis procedure, it is also necessary to correctly identify customers , suppliers and partners.

Also Read : Risk Management | Types Of Risk | Stages Explained