Table of Contents

What is a credit card ?

A credit card is a payment/loan product that a customer can borrow against a line of credit at any time and can repay that loan with a great degree of flexibility.

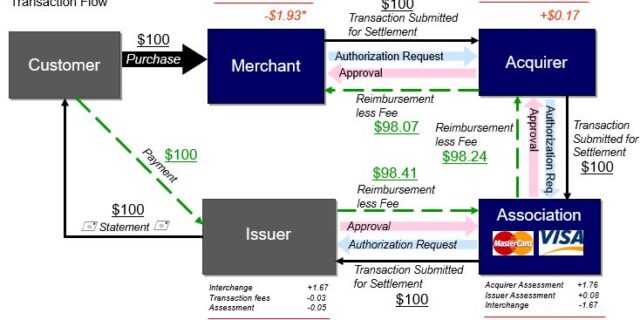

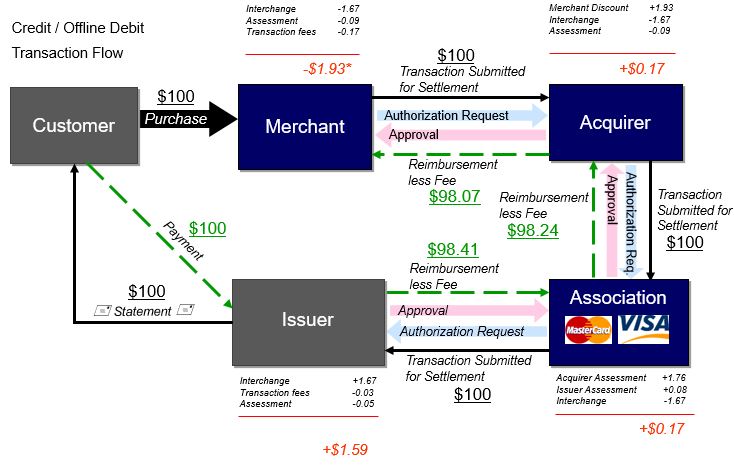

Parties involved in credit card transaction

Cardholder : Customer.

Merchant : Stores where credit cards are accepted modes of payment.Some stores collaborate with banks to provide reward schemes on credit card use. Eg : Croma, Starbucks, Shoppers Stop

Acquirer : Bank providing the EDC machine. Eg : Barclays, Citi, Axis Bank

VisaNet : An association of card-issuing banks sets transaction terms for merchants, card-issuing banks, and acquiring banks. Eg : VISA, Master Card, Amex etc.

Issuer : Bank that providing the credit cards. Eg : Barclays, Citi, ICIC, SBI, HSBC

Credit Card Working Model

Basic Credit Card Business Model

Opening Balance

+ Sales

+ Interest

+ Fees

– Payments

Closing Balance

Every month (billing cycle period) a customer will receive a statement indicating

- The Balance from the Prior Month (opening balance),

- The Total Sales

- The Total Payments

- The New Balance (closing balance)

The Average Net Receivables (ANR) is the average of the opening and closing balances.

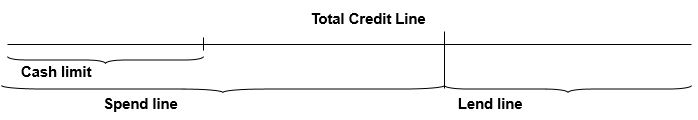

Key concepts- Credit Limit

Maximum allowable credit exposure on the credit card. Depending on market, it can have sub-components: Ex : Spend line and Lend line

Spend line

- Account’s total spend exposure (retail spends and cash advance) should not exceed the spend limit at any point. Customers are provided a little cushion to exceed the credit limit by a very small percentage

- Spend limit has a cash limit component, Cash advances at any point cannot exceed the cash limit

Lend line (ALOP line)

- All the accounts also have a lend limit outside the regular limit of cards. Customer can take installment loans on this limit

- Customers are given line increases periodically.

- Credit limit is dynamically distributed between Spend line and Lend line dynamically based on the usage of card of lend/spend.

Basic concepts- Minimum Amount Due

The minimum amount due on a credit card is the amount required to pay to keep the account in good credit standing and to avoid penalty

-

- It is calculated as x% of total amount due plus financial charges & fees.

Any previous unpaid minimum amount and/or any amount by which you have exceeded the credit limit are added to the minimum amount due.

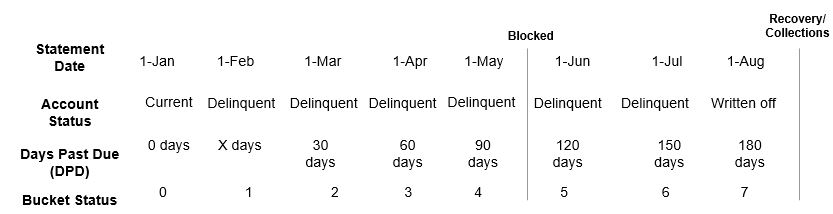

Basic concepts- Delinquency Ageing

If min due is not paid by the next statement date, the account is aged and is considered delinquent.

On system, ageing can be set to happen at due date or statement date. Generally it is set at statement date

With each subsequent month of not paying (or paying less than the min due), the account moves delinquency buckets as explained below. Some accounts might move from a worse bucket to a better bucket by paying.

The percentage of accounts and dollar amount that moves from a better bucket to the worse bucket is referred to as roll rate

‘Collection’ division tracks the month on month flow rates of these buckets. Their aim is to control the flow of the balances in higher buckets

All the unpaid principal balances are written off at 180 DPD. A customer could no more use the card after he/she has gone 90DPD and beyond.

Customer Swipes at a retail store to purchase groceries

“Customer makes a purchase/ transaction”

Interchange

Association Fee

Cost of Funds

“Customer Earns Cash back or Points”

Cash back amount

Rebate cost on points redeemed

Customer transfers balance or withdraws cash

“Transferred Balance”

BT Fulfillment Cost

Balance Transfer Fee

“Withdrawn cash”

Cash advance Fee

“Crossed the credit limit”

OCL Fee

“Receives a statement”

Statement Cost

Types of Credit Card customer

There are mainly Four types of Credit Card customer :

1. TRANSACTOR : “Customer makes full payments by due date”

- Transacting Balance

- Cost of Funds

2. REVOLVER : “Customer pays minimum due amount by due date”

- Revolving Balance

- Interest

3. SLOPPY PAYER : “Customer pays late by few days”

- Late Fee

- Bad check Fee (if cheque bounces)

4. DELINQUENT / DEFAULTER : “Doesn’t Bother to Pay”

- Default Balance

- Written off amount net of recovery

- Collections’/Recovery expense

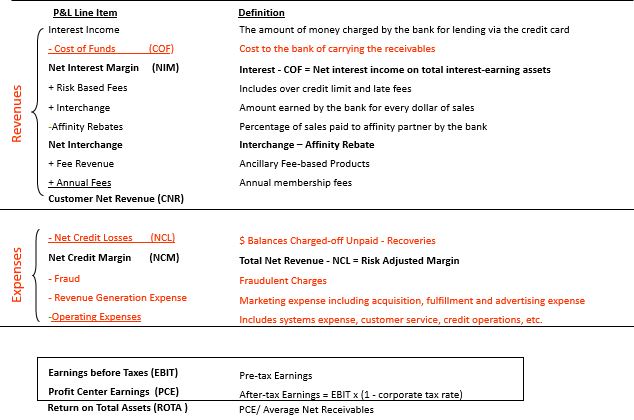

Components of the Credit Card

Also Read : Credit monitoring and Dunning | Explained

2 Replies to “Credit Card Business Model | Key concepts Explained”

Comments are closed.