Table of Contents

What is Credit Risk ?

Credit Risk is the possibility of incurring losses associated with the non-compliance by the borrower or counterparty with their respective financial obligations under the agreed terms, the devaluation of the credit agreement resulting from the deterioration in the borrower’s risk rating, the reduction of earnings or remuneration, the advantages granted in the renegotiation and the recovery costs.

Credit Risk Management is the responsibility of all business units. They are the ones who, in their daily operations, take on risk with a view to the profitability of their business.

These areas are responsible for applying the policies, procedures, systems and models for the identification, assessment, decision, mitigation and measurement of credit risk, throughout the credit cycle (pre-concession, concession, monitoring, collection, recovery and renewal of the credit).

The risk control areas, in order to perform their functions, have unrestricted access to the policies, procedures, systems and models of the business units.

Also Read : Credit Card Business Model | Detailed Key concepts

1. Credit Management

Credit management comprises the steps of: decision, formalization, monitoring and collection, adapted to the profile of customers and segments. This process is operated and controlled by systems that enable continuous monitoring of the quality of the credit portfolio.

2. Credit Risk Control

The governance of credit risk management is supported by committees, which work primarily by evaluating competitive market conditions, defining BCBS risk appetite and reviewing control practices and policies.

OBJECTIVES

Manage credit risk efficiently and prudently, ensuring that exposure to credit risk is correctly identified, measured, managed and controlled; this, within the levels and guidelines approved by the BCBS management bodies.

Integral and dynamic risk management is part of the Bank’s key activities. Credit risk is a fundamental component of BCBS management structure, which is why its management must be structured according to the following general principles:

- Independence: risk management as a priority value, non-negotiable and exercised without concessions in the face of external or internal pressures.

- Objectivity: decision-making is based exclusively on rigorous analysis of information about customers and requested operations.

- Globality: Intervention in the entire risk cycle of the Bank.

BCBS Board of Directors is the body that controls, on a global and periodic basis, the Bank’s Credit Risk management and control process.BCBS risk management, based on the general principles mentioned above, seeks to achieve the following objectives:

- Raise awareness in all areas of the Bank, especially those involved in the credit process / flow, of the need and obligation to achieve the aforementioned objectives;

- Full follow-up of the credit risk flow, from the initial study stage of an operation until its cancellation, including the follow-up and monitoring of credit and an eventual recovery process;

- Provide management information, appropriate for each level of the Bank, on the evolution of risks and internal models, thus facilitating their integration into the Bank’s structure.

- Develop and integrate advanced tools (systems, models) for the control, classification and measurement of credit risk into risk management;

- Achieve a comprehensive knowledge of the risk profile of customers and the segments in which the Bank operates.

- Have complete, consistent databases and mechanisms that allow identifying the original sources of credit risk.

CREDIT RISK MANAGEMENT PROCESS

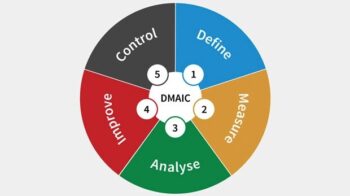

The credit risk management process includes the description and rules that govern all stages of the credit risk cycle: approval, monitoring and recovery.

The objectives of BCBS credit risk process and management aim to establish a credit process in line with BCBS philosophy and mission in terms of credit risk management.

Credit risk is a key component of the Bank’s activities, which considers the existence of comprehensive, proactive and dynamic risk management to be essential. This management must be based on a structure and tools that allow BCBS to achieve the following objectives:

- Facilitate the achievement of the Bank’s strategic objectives through policies adapted to the Bank’s operating segments;

- Efficiently apply the credit risk management policies approved by Casa Matriz, the Board of Directors and the Credit Committee;

- Preserving an adequate solvency level through tools and measures focused on achieving profitability compatible with the consumption of own resources;

- Carry out credit risk management activities efficiently, providing the Bank with an adequate and up-to-date organizational structure on credit risk;

- Implement agile and competitive credit approval, monitoring and recovery processes, with decisions consistent with the assessed risk level;

- Rely on a comprehensive assessment of the characteristics, risk profile and credit quality of customers and BCBS operations;

- Establishing an efficient and relevant differentiation of the types of risk through the classification of exposure by homogeneous risk groups or levels;

- Develop and integrate appropriate and advanced systems, models and other tools throughout the credit risk management process.

The stages of credit risk management

The presence of risk is inherent in every credit operation. Efficient management of the credit portfolio makes it possible to combine the profitability of operations with risk levels that preserve the Bank’s solvency.

The credit risk management process goes from the initial stage of analysis and formalization of an operation until its cancellation, passing through a monitoring phase and, eventually, a recovery process.

Approval process

For credit approval, the Bank establishes a set of criteria that must be met for any operation that involves exposure to credit risk. In this sense, the following aspects are analyzed:

- The activity, history and technical and financial capacity of clients;

- Adequacy of the requested operation to the customer’s needs;

- The structure of the requested operations (guarantees, financial and non-financial covenants, etc.);

- Ratings assigned by external agencies (Moody’s, Standard&Poors, Fitch, Serasa Experian);

- Properly reasoned proposal for classification of Risks according to the scale of the Central Banks;

- The characteristics of the operations to be financed, sector, technology, company experience, etc.

Credit risk formalization and monitoring

In addition to the credit risk analysis and assessment carried out during the approval stage, the continuous monitoring of customers and operations requires that risk monitoring be carried out throughout the life of the operation.

In this monitoring phase, the Bank will take into account factors such as the evolution of the economy, the situation of the client and the sector in which it operates, the existing credit operations (nature, amount, term, etc.). Monitoring / monitoring of risk is based on the following criteria:

- Use of indicators and alert systems for the situation and behavior of customers (external ratings, Serasa Experian alerts);

- Periodic analysis of the portfolio taking into account factors such as the clients’ sector of activity, products, terms, ratings, etc..

- Monitoring of current operations including uses, excesses, delays, rating, documentation, non-financial and financial covenants, etc;

- Periodic reviews of customer status, including updated qualitative and quantitative / financial information. The frequency of these reviews should be at least annually or whenever the relevant credit committee requires it or circumstances warrant (eg, breach of financial covenant, acquisition);

- Reassessment of ratings at least as often as required by the Central Banks;

- Monitoring of the clients’ annual and intermediary financial states.

MAIN CREDIT RISK REPORTS

- Reports of credits approved and used by BCBS customers (monthly);

- Covenant reports due in the next two months and overdue (monthly);

- Overdue review reports (monthly);

- Monthly or quarterly Credit Portfolio analysis.

METHODOLOGY FOR CALCULATION OF CREDIT CONSUMPTION OF DERIVATIVES

BCBS uses the methodology of General cash deposits to calculate the credit consumption of derivatives, namely:

Maximum (PV+ RF*notional , 0) where:

- PV: current contract value.

- RF: risk factor.

- Notional: contract value.

The derivative is monitored daily based on the Mark to Market (MTM) , the limit consumed value is updated every fortnight according to the MTM.

Also Read : What are credit reports and why check them?

One Reply to “What is Credit Risk ? | Methodology and Stages Explained”

Comments are closed.